How much does financial planning advice cost?

Our initial consultation meetings are free of charge, and we offer meetings in person at our Nottingham and Lincoln offices or online for clients around the UK.

We usually charge a one-off fee when your financial plan has been prepared, and then a similar fee on a yearly basis, broken down into fixed monthly payments. These can be paid personally or out of an investment or pension pot in most cases.

Our Guidance Package is designed to provide you with essential information and does not include regulated advice. Costs typically start at £2,770 for a financial plan. An ongoing planning service starts at £1,920 a year. Extra services, including regulated advice, can be added on to the package from our menu at the outset and as you need them after that, according to your circumstances. This service is only available to those who meet our criteria.

Our Focused Advice Package is designed to provide you with essential information similar to the Guidance Package, with the benefit of extra advice in specific areas being added on automatically every year. Costs typically start at £3,790 for a financial plan. An ongoing service starts at £3,790 a year. This service is only available to those who meet our criteria. If you need a wider service, we will recommend our Full Service, where everything you need is included.

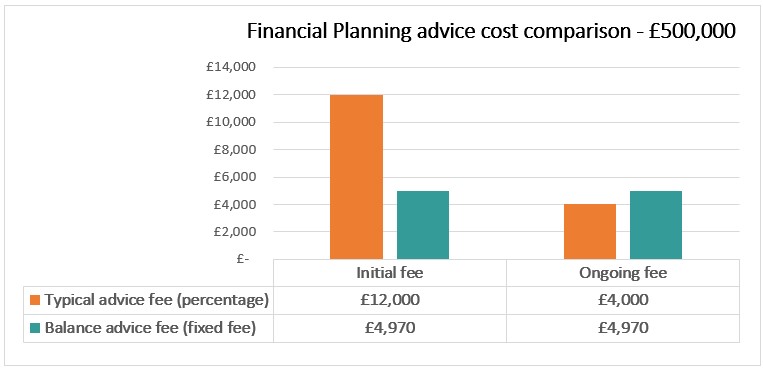

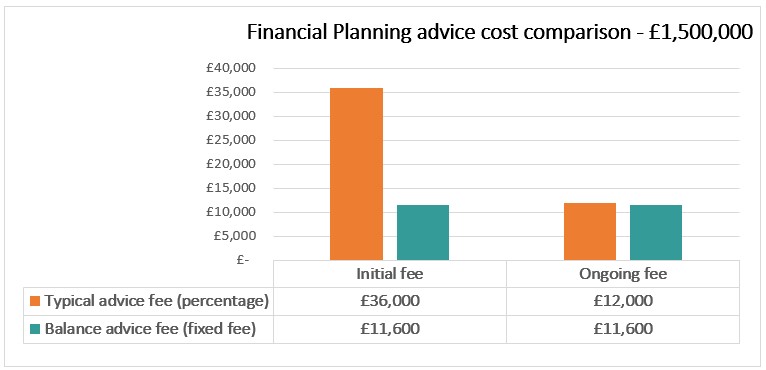

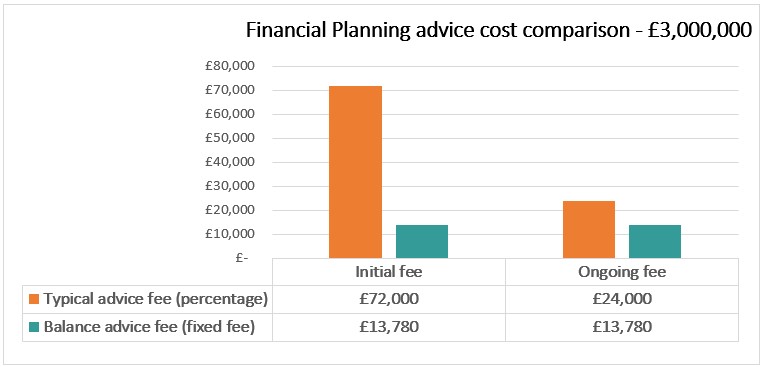

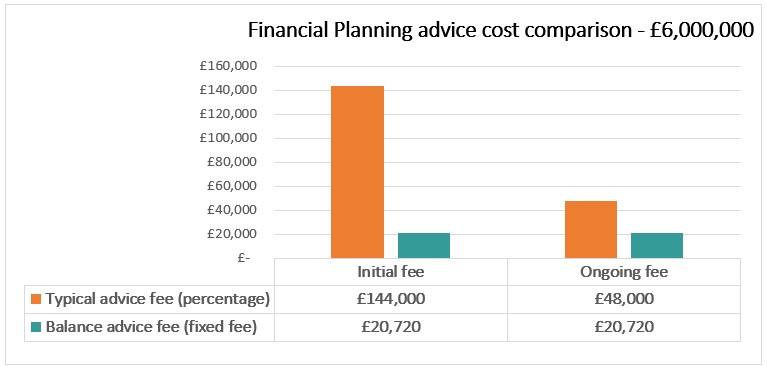

Our Full Service includes everything you need, including carrying out the actions we recommend. Costs typically range from £4,970 – £20,720 when our financial plan is completed, and a similar amount every year. However, our fee can exceed this for clients with more complex or bespoke needs and circumstances, typically found with invested wealth levels approaching or exceeding £10,000,000.

When we calculate our fee, we estimate the expertise and time we will need to commit, to prepare your financial plan and get all your actions completed. If we spend more time than expected, we will usually honour our quoted fee unless your situation is much more complicated than it first appeared.

How do I measure value?

In two ways:

- The increased wealth we are able to generate, through improved investment returns, reduced costs or reduced taxes. This is often substantial and covers our fees many times over.

- The psychological benefit of knowing whether you are financially secure, having an expert on hand, a second opinion, and having your plans in good order. This is incredibly valuable, even though it does not usually have a financial impact – in fact it can mean you feel more comfortable in spending money, so it has the opposite effect!

How do your fees compare?

We are neither the most expensive financial planners you might find, nor the cheapest. We provide a high quality, attentive and comprehensive service, which is priced appropriately. However, we think it’s important to have a benchmark so you can measure what is typical, and what might feel like good value to you.

Surveys from the FCA indicate that the average fee charged by a financial planner is 2.4% of the amount invested at outset. Then a fee of 0.8% a year thereafter, based on the amount invested.

It’s difficult to compare that like-for-like because the way we charge is based on the expertise you need, not the value you may invest. Our planning is also much more comprehensive and wide-ranging. However, if we assume that the more wealth you have, the more complex your needs are, we can give an example of how our fees might compare against the UK average. Here are four examples of low complexity (£500,000 invested), medium complexity (£1,000,000 invested), medium/high complexity (£3,000,000 invested) and higher complexity (£5,000,000 invested):

Why we charge fixed fees, not a percentage

If you have worked with a financial planner or adviser before, you’ll know that they usually charge a percentage of your investments. We don’t work in that way.

We don’t think it’s right that someone with £5,000,000 invested should pay ten times as much as someone with £500,000 invested, unless their circumstances mean they need ten times the expertise and time. We also don’t think it’s right that clients’ service should be determined by how much money they have. It’s a dated and opaque way of charging for valuable professional support, but yet nearly all financial advisers still operate in this way. We are part of the movement for change.

Everyone’s circumstances and needs are different, so the fees you pay should reflect that.

We believe that fixed, all-inclusive fees are more transparent and fair on you. Our clients know exactly what they are paying for when it comes to the financial planning advice and investment management from us. Nothing is hidden and there are no extras.

Does everyone pay the same amount?

No. We tailor our service to suit you. As a result, we can offer an attentive service to clients with complex circumstances and requirements, or a ‘light touch’ service if that suits you better.

How are the fees calculated?

We form a high-level picture of the planning you’re likely to need, how complex it is, and the time that will take to attend to everything for you. Based on the expected time spend from various people within our team, we calculate an initial fee. That initial fee provides you with everything you need – from the exploratory discussions, going through our advice and implementing whatever we have recommended. It is totally inclusive, with no extras.

For clients having an ongoing service, it’s much the same. We find out how often you would like to meet and review your plan during the year (most people review their plans yearly) and what sort of planning support you’ll need during the year. From that, we can give you a monthly fixed fee. This monthly fee is also totally inclusive of anything you could need in the year. Whether that’s making an adjustment to your pension contributions, setting up Junior ISAs for your children or grandchildren, or helping you invest money from a long lost aunt.

If you invest in one of our in-house portfolios there is a small charge of 0.2% to cover the ongoing management costs. You can read more about the Balance Wealth Core Portfolios and Balance Wealth Good Practice Portfolios on our dedicated investment website.

How are fees paid?

Our fees can be paid from your bank account, and you will usually also have the option to pay them from your investment or pension pots.

How do I get an indication of fees for my plan?

The best way to find out how much it would cost to give you the financial planning advice that’s right for you, would be to contact us and tell us about your situation. That can be at one of our offices, by phone or a Teams video call. Once we know more about you, we will send you a considered personal proposal, setting out the key planning we think you would benefit from and what our fee will be. Naturally, we will also adjust our fee if the service you need changes over time.

Am I tied in?

Of course not. You are never tied in and can leave at any time.