At the PA360 conference, our founder, Rebecca Aldridge, joined a panel of forward-thinking advisers to explore an issue close to our hearts: why the empathy in retirement planning is becoming more important than ever.

Retirement is a major life transition. For many, it’s the first time they stop and seriously ask, “What’s next?” But too often, traditional financial advice focuses solely on numbers—ignoring the complex emotions, motivations, and fears that sit beneath the surface. Empathy in retirement planning is essential to address those deeper concerns. That’s where financial planning differs.

As Rebecca noted at PA360, being there for clients—especially through uncertainty—has never been more important.

Empathy in retirement planning builds confidence

During the panel, Rebecca shared how great advice isn’t just about asset allocation or tax wrappers—it’s about helping people feel safe, understood, and in control. Whether someone wants more time, less stress, or to support their children, it’s that emotional clarity that shapes meaningful plans.

At Balance: Wealth Planning, we take a goals-based approach backed by lifetime cashflow planning. This structure helps bring clarity to big questions like “Can I afford to stop working?”—but more importantly, it provides reassurance through uncertainty. Empathy in retirement planning is what turns a good plan into a great one.

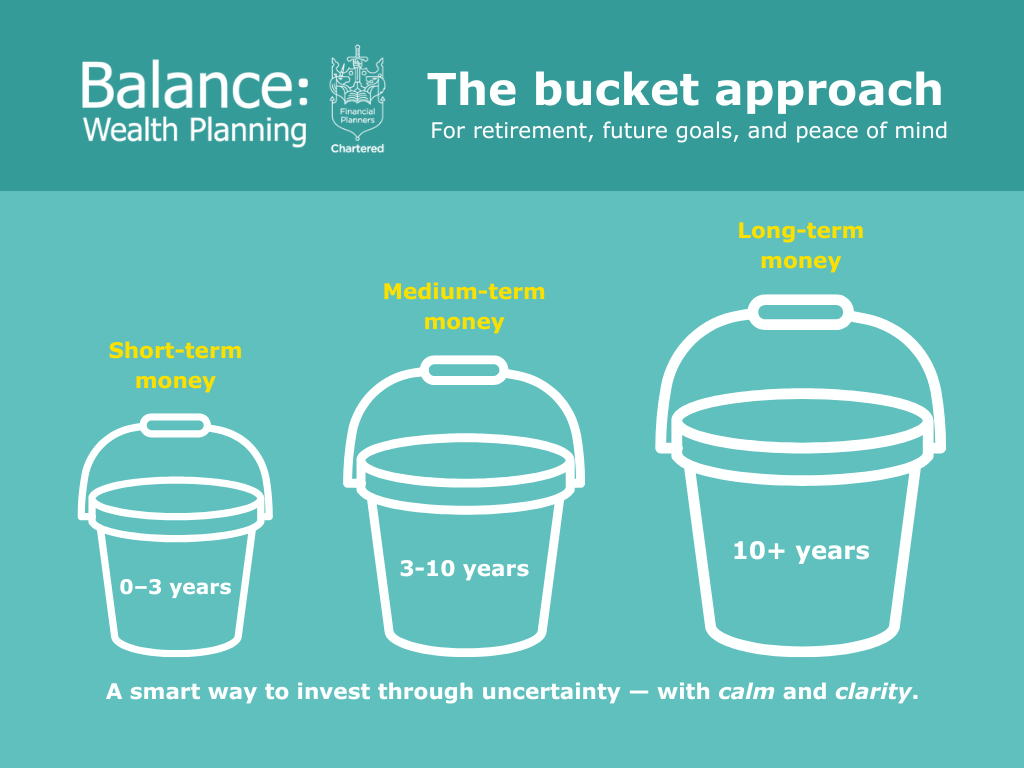

Rebecca also shared Balance Wealth: Planning’s “bucket” strategy—using different pots of money with different risk levels depending on short- or long-term needs. It’s a structure that helps clients stay calm and in control, even during market dips.

It’s about the person, not just the plan

The transition into retirement brings emotional shifts alongside financial ones. People often carry unspoken worries:

- “Will I run out of money?”

- “What will I do with my time?”

- “Can I still support my family?”

Rather than rushing to solutions, we take time to listen. “Clients sometimes appreciate a blunt or critical friend approach,” said Rebecca at the PA360 panel, “as long as they know we’ve prepared together.” That’s the foundation of how we work: with care, clarity, and empathy at every stage.

Great advice blends technical expertise with human understanding.

A human-first future for financial advice

The panel discussion at PA360 was a powerful reminder that as the world changes, advice needs to change with it. We believe empathy in retirement planning will shape the future of financial advice—and we’re proud to be setting the standard.

At Balance: Wealth Planning, this has always been our philosophy:

- We care deeply about our clients

- We solve problems with creativity and clarity

- We’re pioneers in doing things differently

We combine:

- Technical precision

- Thoughtful questions

- Deep listening

- And empathy.

Because money decisions are never just about numbers—they’re about real people and real lives.

Want to explore what retirement planning could look like for you?

Let’s have a chat. We’d love to help you build a plan that’s not only financially sound, but truly aligned with the life you want to live.