Ukraine’s glory hasn’t perished, nor freedom, nor will. – Ukrainian National Anthem

It’s been very difficult to watch the scenes in Ukraine over the last few days, and as people remain perplexed at Putin’s attack, what has been clear is the strength and resolve of the Ukrainian people. Their bravery is beyond belief.

The world quickly united in its message of solidarity, and we have seen a global movement rooted in standing against such aggression – imposing sanctions, sending military aid, and humanitarian support.

As ceasefire talks begin, we are hopeful that more peaceful means are taken to resolve this crisis.

As with any political disruption or major world event, our thoughts and concerns lie first and foremost with the victims. However, the financial markets have also felt the impact of the uncertainty, and we understand this may be causing you extra concern.

The impact on investments

You may have seen that the investment markets fell towards the end of last week. However, they have since rallied but not fully recovered. Nevertheless, the financial headlines can add an extra dimension of worry in times like these when you’re an investor, so we wanted to remind you of a few key things:

- The headlines may not be a true reflection of your investment – They tend to be about the FTSE100 performance (the index of the UK’s top 100 companies’ share values). However, your portfolio may comprise of different asset classes and countries. A well-diversified portfolio is designed to reduce the risk and impact of such events. It’s worth checking your investment allocation if you are unsure.

- Financial plans are long-term – Your capital will need to last your lifetime, so your investments should be made with that in mind, and not seen as a short-term fix. As part of our planning process, we carefully map that out and stress-tested it to ensure it would withstand the worst-case scenarios and still achieve all you planned.

- We’ve seen it before – Although not exactly the same, and by no means to take away the gravitas of what’s going on, geopolitical events have occurred previously, and the market has reacted similarly. We delve into the detail a bit further below.

Past events & what we can take from them

Although past events do not guarantee what will happen in the future, we can draw upon previous experiences. Looking at market returns surrounding historic geopolitical (military) events since 1939, across the 15 major events:

- Before the events – Three months before, only 40% had positive markets with an average overall return of -1.5%. One month before, things looked even worse, with only 27% experiencing positive markets and an average return of -2.7%.

- After the events – within one month, 53% had positive markets and experienced an average return of 1.20%. And within 12 months of the event, 73% were positive again, with an average return of 9.7%.

Simply put, before and leading up to most political events, markets had a heightened period of uncertainty, followed by a period of growth across world markets with them bouncing back relatively quickly and better than before (Source: Bloomberg, LGT Vestra LLP).

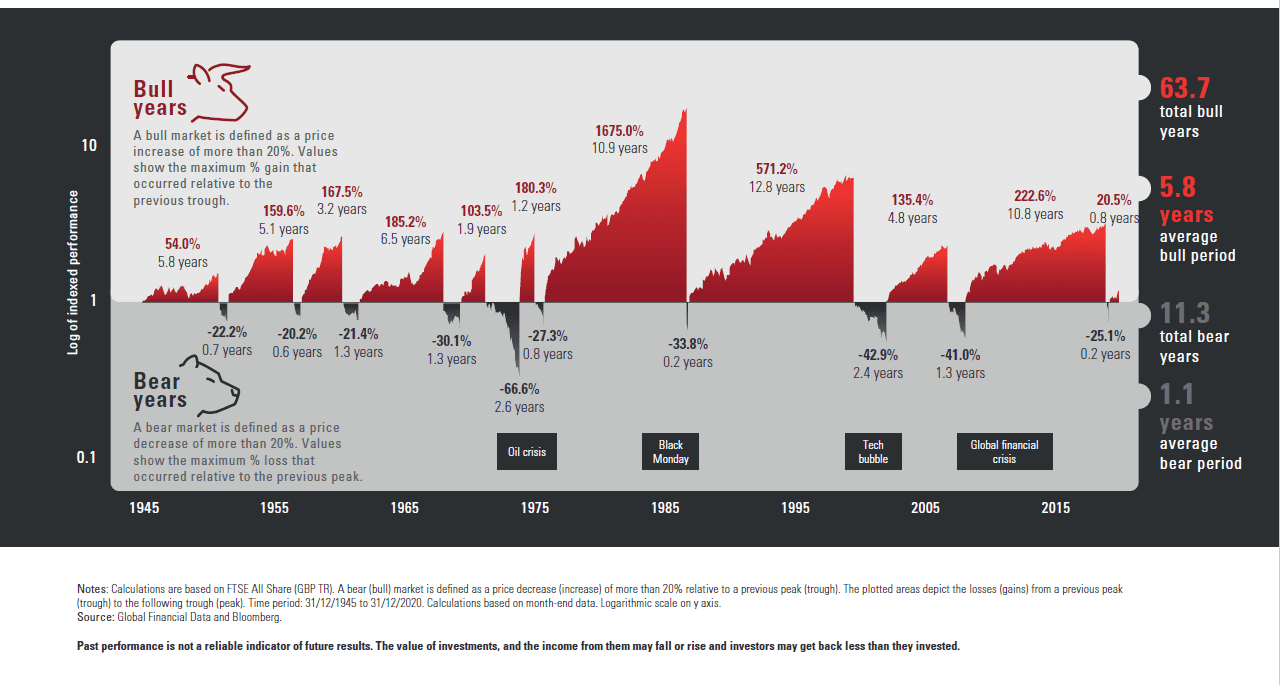

The chart below looks at the FTSE All-Share between 1945 and 2020. It includes various events that resulted in market drops and caused both bull and bear markets (explained below), such as wars, financial crises, terrorist attacks and a global health pandemic.

(Source: Vanguard)

It’s never easy seeing values drop, and the rhetoric in the media only compounds this.

When facing uncertainty, it’s natural to want to regain control, but you might cause yourself more damage if you react, rather than stay the course.

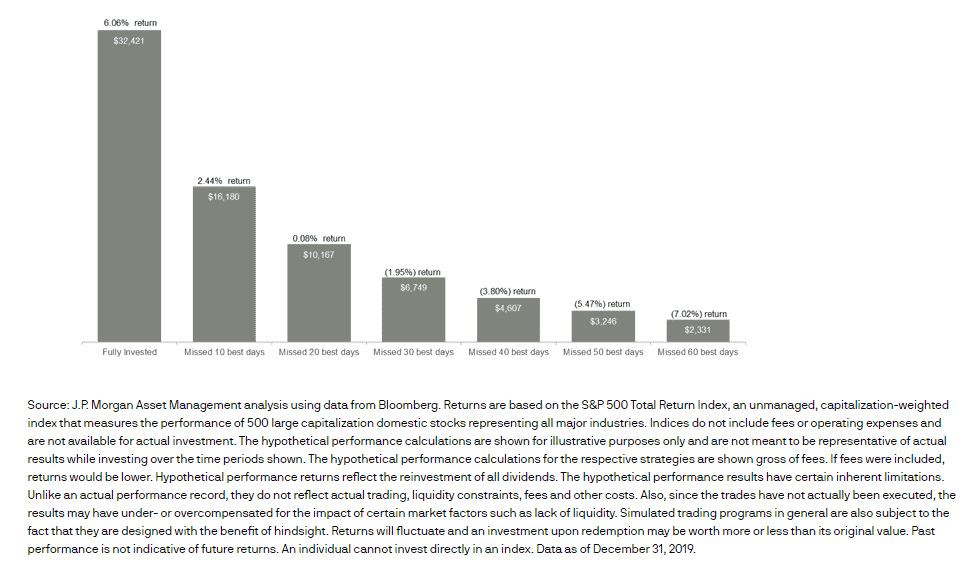

Research by JP Morgan found that over the past 20 years, those that remained fully invested throughout that time saw a 6.06% return per year, compared to those who sold and missed the 60 best days of market performance and received a negative return of -7.02% per annum.

(Source: JP Morgan – Impact of being out the market report)

Even more compelling, JP Morgan’s study found that the best and worst days were also very close together, with six market highs being within two weeks of the lowest. Making those positive returns even easier to miss if you don’t resist the urge to sell. Therefore, we strongly reinforce that you do not try and time the market.

“We cannot direct the wind, but we can adjust the sails.”

So, what should you do?

Retain focus and trust the financial planning process.

While we may continue to see more market changes over the coming weeks, it’s important to retain focus on your long-term goals rather than fixate on the short-term fluctuations.

Given the above evidence, our advice would always be to trust your financial plan. And if you don’t have one, then it’s time to invest in one. Our planning and investment philosophy are built on tried and tested principles and are robust enough to withstand such events as we recently see in the news.

If you have any concerns you would like to discuss; we are always here to support your financial journey, so please contact us. In the meantime, all of our thoughts remain with those in Ukraine, and we hope safety and stability return to their country soon.

Please note: Past performance is no guarantee of future return. The value of investments and their income can go down and up. You may get back less than put in. In addition, transaction costs, taxes, and inflation reduce investment returns.