Even if something looks green and shiny on the outside, it’s important to look under the bonnet to see what’s actually going on.

In this post, we’ll be looking at the criteria that are to be considered when thinking about values-based investing and how these metrics have become closely linked to the UN’s Sustainable Development Goals.

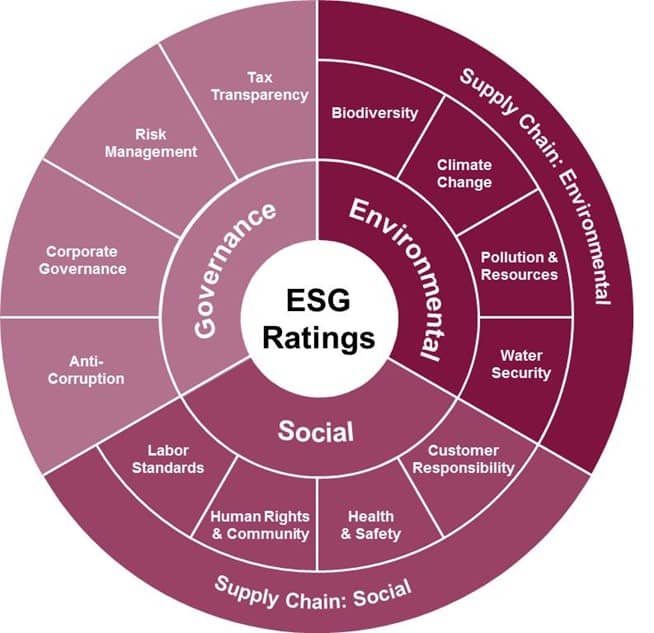

Environmental, social and governance (ESG)

Environmental, social and governance is an umbrella term for the six areas we explored in our previous blog post. Typically, business data is collected and mapped to its ESG area. When used alongside other traditional financial metrics the data provides a deeper understanding of the risks and opportunities associated with an investable company and allows fund managers to choose which companies to invest in and which to avoid.

In 2001, the FTSE Group launched a series of benchmark and tradable indexes for ESG. This index series was designed to measure the performance of companies that communicate strong ESG practices. See the ESG ratings data model below.

Source: FTSE4Good

The main point to note here is that ESG is data. How the data is used can vary widely.

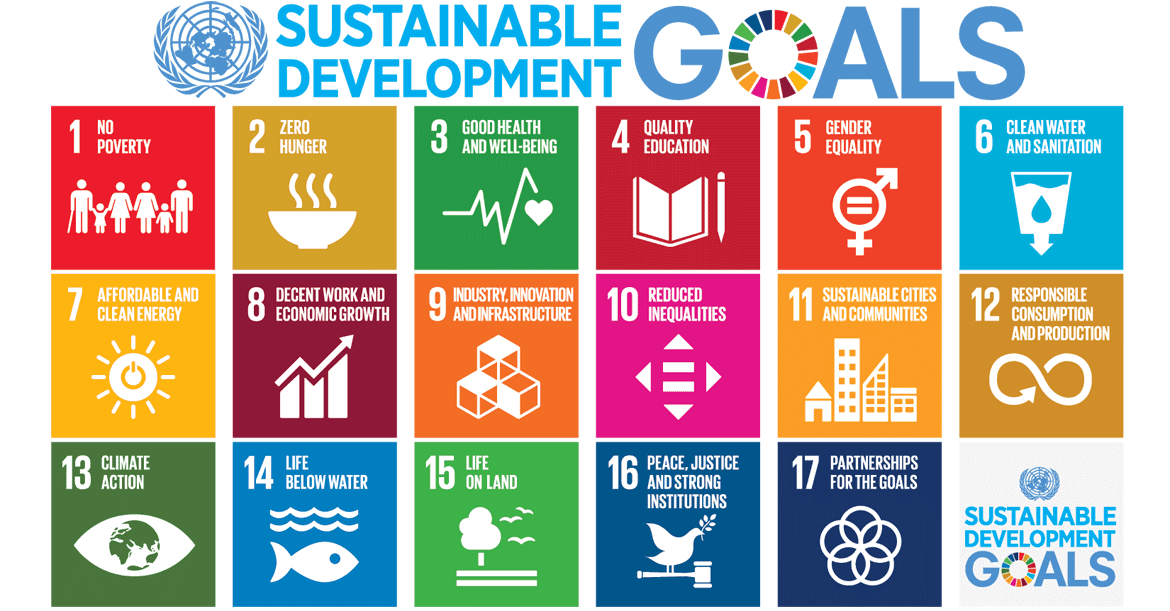

United Nations Sustainable Development Goals

Source: UN

The 2030 Agenda for Sustainable Development was adopted by all United Nations Member States in 2015. This blueprint provides a set of goals aiming to achieve peace and prosperity for people and the planet, now and into the future.

The 17 Sustainable Development Goals (SDGs) (as shown above) are an urgent call for action by all countries – developed and developing – in a global partnership. They recognise that ending poverty and other deprivations must go together with strategies that improve health and education, reduce inequality, and spur economic growth – all while tackling climate change and working to preserve our oceans and forests.

The SDGs build on decades of work by countries and the UN, including the UN Department of Economic and Social Affairs. Written originally for governments and policymakers, they now go beyond this and stretch into investment and asset management.

We are increasingly seeing companies’ ESG values and ratings being cross-referenced with the SDGs. We believe this is important because the SDGs provide a vital framework and lens that allows investments to be mapped onto the areas of impact in the ESG criteria, which is what many companies and asset managers use. Whilst some of the SDGs may cross over one of the three areas, we believe they can be broadly categorised as follows:

Summary

The main point to note here is that the more transparent and readily available individual companies make their data, then the better this will feed through to fund managers when constructing investment funds or portfolios.

It’s important to look beyond the label to truly understand whether an individual company or fund manager is really living their values or simply paying lip-service as a marketing gimmick.

We hope this blog helps to understand the commonly used terms – ESG and UN SDGs – and their role/benefit in wealth management. In our next blog post, we’ll look at why values-based investing is important at a local and global level and who it’s important for.

If you would like to know more about values-based investing and how we can help, please get in touch and speak to one of our Financial Planners.