Cashflow modelling is one of the main components of a robust financial plan. But what is it and what are the benefits?

It’s not very often that people walk into a shop to buy an item without checking the price tag; a quick sense-check to make sure it’s affordable before you go to the counter. Maybe you might pop it on the card and not think about it until the end of the month. But when it comes to planning big life events, cashflow modelling will be a crucial tool in understanding your financial situation and helping you visualise the future.

Here at Balance: Wealth Planning, we are big advocates of cashflow modelling, but according to Professional Paraplanner, only 34% of advisers offer cashflow modelling as part of their service for all clients. Yet, 70% agree this is the best tool for helping clients achieve their long-term goals, and 67% say cashflow modelling has helped reduce client worry during the pandemic.

What is the purpose of cashflow modelling?

Cashflow modelling is a detailed look at the money coming in and out throughout your lifetime. It’s a fluid picture, allowing for variables such as tax, inflation, and investment scenarios, to name a few.

And why is it important? It’s all about timing, as with anything in life. When we decide to do something, it’d be nice to know it’s the right time to do it, and it won’t have consequences later down the line.

As we know, and had reaffirmed over the past 12 months, the future is unpredictable and never guaranteed. But a sophisticated cashflow can help you understand your financial resilience, especially in times of uncertainty. It shows you the impact of your choices and when you choose to do them.

Our financial planner, Caroline Keegan, explains cashflow modelling in terms of jumping in a time-travel machine. Imagine you get into a glass bubble, bounce forward 5 – 10 years and step outside to look at your financial picture. Ask yourself: what does it look like, and are you happy with it? Then we’re going to step back inside the bubble, come back to the present day and make any changes that we need to until you are happy with it.

Remember: This is just the first step. The real value comes from an annual review where we will repeat this process to keep your plan up to date as things change.

What are the benefits of cashflow modelling?

Visualisation

Cashflow modelling can show you what is possible, what isn’t possible and what you can do instead to get you to where you want to be. A cashflow provides a graphic representation of your personalised roadmap, highlighting your goals and objectives along the way. You can see the impact each of them has and if they are affordable to you. It can confirm if you’re on the right path, or if a slightly different route is needed to get you there.

Our planner, Krupesh Kotecha, likened cashflow modelling to a jigsaw puzzle. When clients come to us, they have questions they want answering, and without cashflow planning, it’s like trying to put a 3D jigsaw puzzle together in their head. Cashflow planning not only enables us to put this jigsaw together; it also lets us see and feel the plan and make changes to test out different scenarios to see what’s possible.

Resilience

We always want things to go as planned. But what happens if they don’t? A robust financial plan has explored lots of eventualities and has been stress-tested. Stress-testing shows various ‘what if?’ scenarios. Say you want to know what happens if the markets drop, you were to fall ill, or your income was to reduce, cashflow modelling maps these scenarios to see how resilient and healthy your situation is.

How powerful would it be to know that some of the worst-case scenarios, although not ideal, would be manageable from a financial perspective? That means one less thing for you to concern yourself with at a difficult time.

Freedom

Knowing that you have options can be life-changing. No one wants to feel stuck. However, cashflow can show you that there are options out there for you, which can be just what you need to hear.

For example, one of our planners worked with someone who was feeling very stressed in their work. What the cashflow modelling did was showed that they could stop work immediately. And this knowledge rejuvenated them in their work. They realised it was now a choice, not a chore.

Confidence

Cashflow modelling allows you to try before you buy, so you can feel confident that you’re making the right financial choices. It takes your desired lifestyle for a spin in a safe environment before leaping and making a change.

Peace of mind

How we spend our money can have a significant impact on our future lifestyle and potential opportunities. But, as always, knowledge is power. It starts with knowing what you have, and then cashflow modelling shows you what this can do for you. The outcome: you gain the peace of mind to feel secure in your financial future, which is priceless!

Cashflow modelling in action

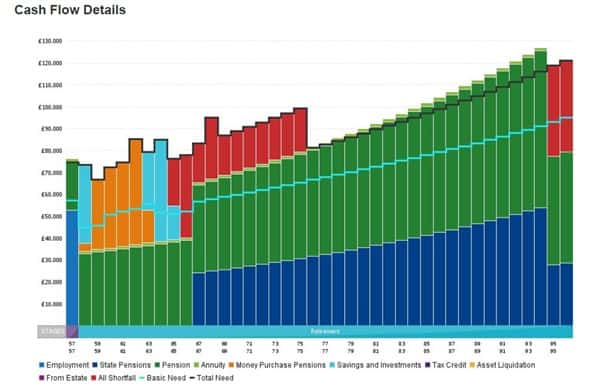

Here is an example cashflow modelling exercise based loosely on our financial planner, Tina, and her husband, Keith.

In this example, Keith has already retired, and Tina would like to retire at age 58. The black line is their total income need, and the blue line is their basic needs. The other blocks of colour are their different income streams, and the red is the shortfall. The next step would be to look at various scenarios to fill in those gaps. And the result might look a little something like this:

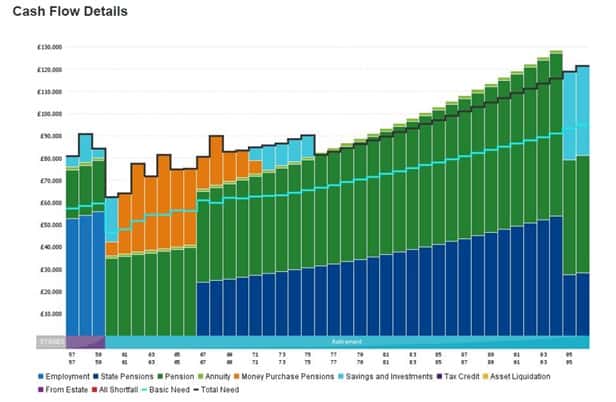

With Tina working until age 60 and continuing part-time after, saving more into pensions, and easing back on expenditure, their position looks a lot rosier.

Our role as financial planners is to make sure our clients don’t run out of money. BUT also, that life is for living, not saving. An empty bucket is a problem. But an overflowing bucket is not a success story. It usually means you held back and missed out on experiences when you had the chance.

Everyone’s approach to money varies, but cashflow modelling will help everyone see things differently.

If you would like to know more about cashflow modelling and how it can help you, please don’t hesitate to get in touch with one of our trusted financial planners.