We’ve all heard the phrase money can’t buy you happiness but unlocking your financial freedom through financial planning will certainly help.

Since March 2020, amongst the backdrop of COVID-19, research carried out by the Office of National Statistics (ONS) shows that 25 million people have experienced ‘high’ levels of anxiety, and 5.3 millions of those were mainly concerned about their finances.

With Financial Planning Week on the horizon (5th – 11th October) it’s a great reason to start talking about finances, and how financial planning can ease some of those concerns.

What is financial planning?

Financial Planning is about taking control, providing you with clarity and having a vision of what you want and taking you there.

It helps you plan for the future so that you can focus on living now. It gives you the freedom and peace of mind that you can do the things you want to in life.

There are six key steps to financial planning, which are:

- Your vision and goals

- Your money

- Is there enough?

- Your financial plan

- Make it happen

- Review your plans

Financial planning isn’t prescriptive, and everyone has a different journey, but the destination is the same – financial freedom.

When might you benefit from financial planning?

Almost everyone could benefit from having a financial plan. But planning can be of particular benefit if any of these apply to you, or anyone you know:

- You feel like your money isn’t organised and you don’t know what you have

- You’re hoping to retire in the next few years, but don’t know if you’ve got enough to do that

- Your situation is going to change shortly (perhaps you’ll sell a business or receive an inheritance for example), and you need to know what to do with the money

- You want a change of lifestyle, perhaps a change of job or to set up a new business and aren’t sure whether you can afford to take the risk

- You think you pay too much in tax and want to see if that can be reduced

- You worry about what would happen if you couldn’t work or lost your job

- You’re worried about inheritance tax

- You’d like your money to have a positive impact, either locally or globally

You want to make sure that your finances align with your values

How can financial planning unlock your financial freedom?

There are lots of benefits of financial planning, but it may surprise you that the value of advice is not just monetary.

Having money shouldn’t be an aim in itself, and that’s why the old chestnut, as we mentioned before, ‘money can’t buy you happiness’ really is true. It’s what money does for you that is important and is the key to unlocking your financial freedom.

Financial planning is starting at the basics, understanding what you want to achieve, what your visions and goals are for the future and planning out the steps to get there, hopefully, sooner than you think.

Getting organised and having a plan is proven to boost your wellbeing, with a recent study by Royal London showing that those who received advice felt more confident and in control. Not only that, those that take advice are on average £47,000 better off than those that don’t take advice. And, it doesn’t stop there, those that had an ongoing service from an adviser were 50% better off than those that took a one-off bit of advice.

However, beyond the numbers, financial planning offers something even more important – peace of mind.

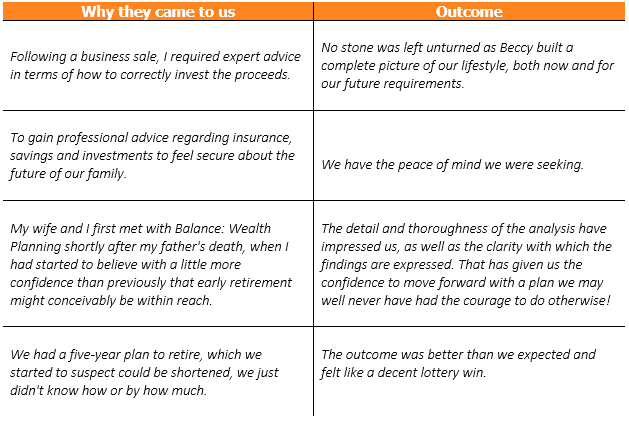

But don’t just listen to us, what have our clients said?

If you are interested in finding out more about financial planning, Balance: Wealth Planning will be supporting Financial Planning week (5th – 11th October 2020).

What is Financial Planning Week?

It’s a campaign run by the Chartered Institute for Securities & Investment (CISI) that aims to boost the financial fitness of the UK public by giving everyone a helping hand to improve their financial wellbeing, resilience and life goal planning.

What we’ve got planned:

- ‘What is Financial Planning?’ free webinar – Thursday 8th October – Register here

- Free 1-1 consultations, which can be booked here

We look forward to seeing you there.

Alternatively, if you have any questions or would like to discuss your finances or an existing financial plan, then please get in touch with us and speak to one of our financial planners.