You may know who we are and what we do, but are you still unsure about why you might need a financial plan in place?

Maybe you’re a small business owner, an engineer or a senior executive. If you have a vision for the future but you’re not sure how to organise your wealth appropriately to achieve your goals, financial planning will help guide you in the right direction.

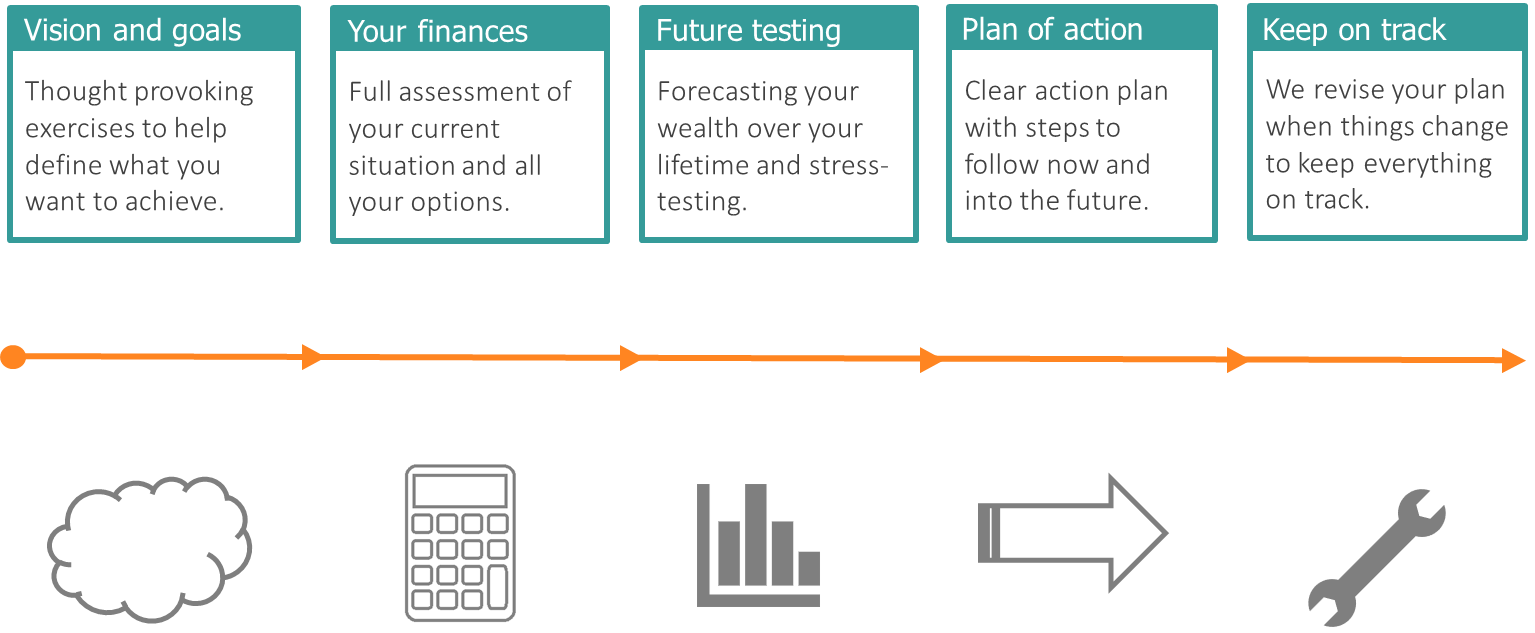

Simply put, financial planning is an ongoing process to help you make sensible decisions about your money and give you the best chance of achieving your life goals.

Here are a few key reasons why people seek the help of a financial planner:

Realising your goals

The first step in financial planning has absolutely nothing to do with your money, it’s all about focusing on the important visions and goals that you have in life. Money is merely a driver, it’s the end destination that forms the basis of your financial plan!

This is where the real value of your discussions with a financial planner is.

Increasing income/reducing costs

You could be missing a trick by not maximising your tax allowances, pension pots or investment strategy. Alongside this, monitoring your spending, carefully budgeting and tax planning will help to improve your cash flow so you can get the most out of every penny.

Preparing for life/wealth changes

Maybe you’re worried about what would happen if you couldn’t work or lost your job. Financial planning can help you create a contingency plan by establishing where you can make spending cuts or increase your income so that you’re able to grow an emergency fund.

Or, if your financial situation is expected to change shortly, and you want to know what to do with the money, a financial planner can use their expertise to advise you on where you are best using your money to get the most out of it.

Even if you’re just wanting a change of lifestyle, a change of job or to set up a new business, wealth forecasting can be used to effectively assess whether you can afford to make that transition.

Planning for retirement

Gaining an understanding of what your retirement might look like, helps to identify if you can bring your retirement forward or if you could be doing more with your money now to benefit later.

By understanding your vision for the future, and forecasting your wealth over your lifetime, financial planning paints a clear picture of what you can (and can’t) achieve. Based on these findings, a combination of careful planning, minimising taxes and making your money work harder, optimises your wealth so that you can reach your financial goals.

Gaining financial understanding

If you feel like your money isn’t organised and you don’t really know what you’ve got, a great financial plan will map out your entire financial situation, both now and in the future. This will allow you to make better informed financial decisions and measure whether you are staying on track to achieve your goals.

Most importantly, having a greater understanding of your finances will give you more control over your lifestyle. It gives you the security to live life to the fullest and increase your standard of living, knowing you can afford to.

Ongoing advice

Ongoing advice is extremely beneficial in that your situation gets reviewed and revised regularly so that when circumstances inevitably change you are able to keep your finances on track to reach your aspirations.

How can financial planning help you?

Financial planning is comprehensive, it looks at all aspects of your life now and what you want to do in the future. It’s also long-term in nature so we’re not just thinking about what you need to do now, it’s thinking medium-term and longer-term so you can plan ahead and secure your financial future. But maybe it’s better to hear exactly how it can help from a client’s point of view…

This is Dave’s financial planning story:

“My wife and I first met with Balance: Wealth Planning shortly after my father’s death, when I had started to believe with a little more confidence than previously that early retirement might conceivably be within reach. Tina spent significant time with us going through a really thorough (and actually enjoyable!) process assessing our life position and preferences, vision for the future and of course financial landscape.

She was incredibly patient with us as well – I’m a lay person with a little knowledge, which is always dangerous and potentially frustrating for real experts, but her patience and good humour has never wavered. The detail and thoroughness of the analysis has really impressed us, as well as the clarity with which the findings are expressed. That has given us the confidence to move forward with a plan we may well never have had the courage to do otherwise! And as we proceed, their ongoing help, advice and support has been brilliant. In short, I’d recommend Tina and the whole support team at Balance Wealth without hesitation”.

If you would like any help with financial planning, or you would like to discuss any aspect of this article, then please get in touch with us now and speak to one of our financial planners.

Feel free to subscribe to our newsletter to receive all of our latest news and articles straight into your inbox every month.